MUST READ....ABARES - Faba Bean Dec Forecast – Expanded Analyst Report

- Simon Hutt

- Dec 2

- 3 min read

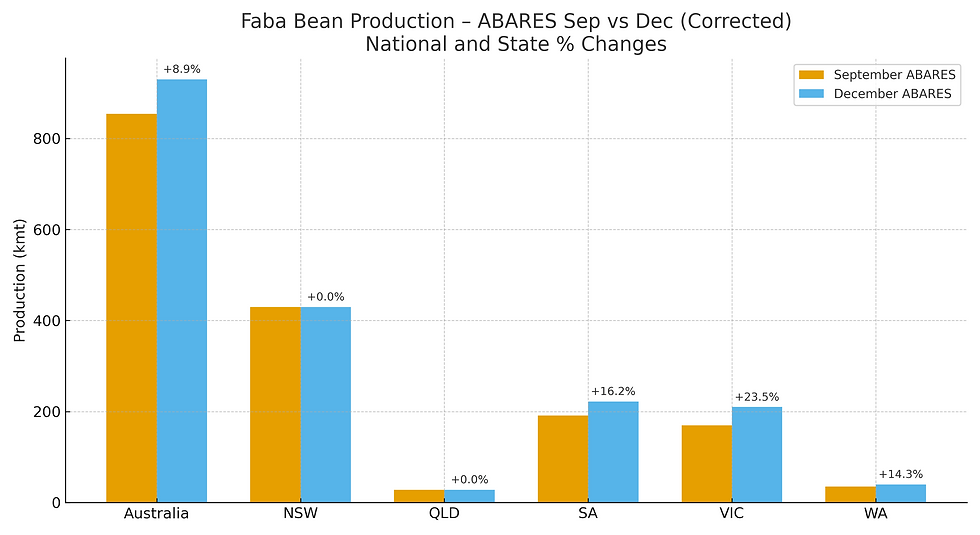

The big one we were expecting - Faba Bean National production forecast is UP ~9%.

Executive Summary

As previously communicated, the Australian faba bean market was already on track for a surplus position.

The December ABARES update confirms that this surplus is not only real but significantly larger than expected.

National production now sits at 930kmt, up from the September estimate of 854 kmt.

This +9% uplift reinforces the structural imbalance: supply now materially exceeds both domestic demand and export capacity.

With elevated carry, constrained export programs, and softened demand from Egypt and MENA, our earlier guidance that February–April would show the key price weakness is now strongly validated.

1. State Production Breakdown – December ABARES

The December ABARES update provides the following production outcomes:

NSW now accounts for 43% of national production, creating significant inland surplus pressure.

SA remains the primary export‑aligned state, whereas VIC faces competition between domestic feed and export channels.

WA remains export‑dependent, and QLD continues to benefit from strong domestic feed demand.

2. ABARES National Forecast Revision – September vs December

The national crop has been revised from approximately 854 kmt in September to 930 kmt in December.

This represents one of the larger quarter‑on‑quarter faba bean upgrades in recent years, driven primarily by exceptional yield conditions across NSW, VIC and SA.

Late‑season rainfall and mild pod‑fill conditions were the critical catalysts behind this unexpectedly strong finish.

3. Regional Market Analysis

New South Wales – 430 kmt (no change)

NSW is the epicentre of Australia’s surplus.

With 175 kha planted and yields of ~2.46 mt/ha, NSW alone generates 43% of national supply.

This volume far exceeds local consumption and will exert downward pressure on pricing as growers move grain during February–April.

NSW inland bids will likely set the price floor nationally.

South Australia – 222 kmt (16.2% increase)

SA remains Australia’s premium export pathway, but port congestion driven by a heavy lentil program will restrict faba elevation.

Although SA beans maintain the strongest relative values, the pricing ceiling is capped by pricing from Egypt.

The February period will still trigger price weakness, as limited export demand capacity is completed.

Victoria – 210 kmt (23.5% increase)

Victoria balances between export and domestic feed demand.

Early‑season premiums for brightness and size diminish into late summer as NSW (massive) oversupply pushes cheaper beans south.

Inland VIC values will fall substantially as growers seek liquidity.

Queensland – 28 kmt (no change)

QLD remains buffered by its domestic feed base.

While southern surplus will weigh on values, QLD retains a premium relative to NSW and VIC.

Downside risk is milder here than elsewhere.

Western Australia – 40 kmt (14.3% increase)

WA’s market is dictated almost entirely by export timing.

When a shipping program is active, bids firm.

When not, values weaken sharply due to negligible domestic demand.

In a national surplus environment WA remains volatile.

4. Export Demand Stress Testing

As we have previously pointed out, the Egypt driven export demand in vastly reduced this season.

Our forecast estimates reduce the export demand from 400kmt to around 250kmt.

We believe domestic demand will increase from around 250 kmt to ~400 kmt, however we have mapped possible reductions of a further 10–30% to export demand and the generation of substantial additional surpluses.

Even the mildest reduction yields a 380 kmt surplus; deeper cuts approach 460 kmt.

These volumes far exceed Australia's domestic capacity and reflect the structural imbalance.

5. Pricing Outlook – Updated Against Previous GrainSource Commentary

Our earlier analysis indicated flat pricing through harvest followed by a February down‑leg.

The December ABARES forecast uplift strengthens this call.

The heavier supply, slower export pull, softer MENA demand, and limited port capacity create a deeper and more persistent decline across NSW, VIC and SA.

QLD remains relatively stronger, while WA is volatile and export‑dependant.

6. Strategic Conclusion for Clients

The Australian faba bean market has moved decisively into a structural surplus position.

Production exceeds both export capacity and domestic demand by a wide margin.

This reinforces the need for proactive marketing strategies and realistic price expectations.

Buyers will find advantageous conditions from February onward, while growers face a market defined by heavy supply, soft export demand, and tightening logistics.

Comments